Still on knife edge

Labour demand and economic growth have stalled

Statistics Canada released the Q3 balance of payments data (a prelude to Q3 GDP on Friday 28 November), and the September Survey of Employment, Payrolls and Hours report (SEPH) report. This is essentially Canada’s establishment survey, which in the US is the closely tracked non-farm payrolls report.

Included in the SEPH is a report on job vacancies and payroll employment. Together, the number of job vacancies and payroll employment provides an estimate of total labour demand.

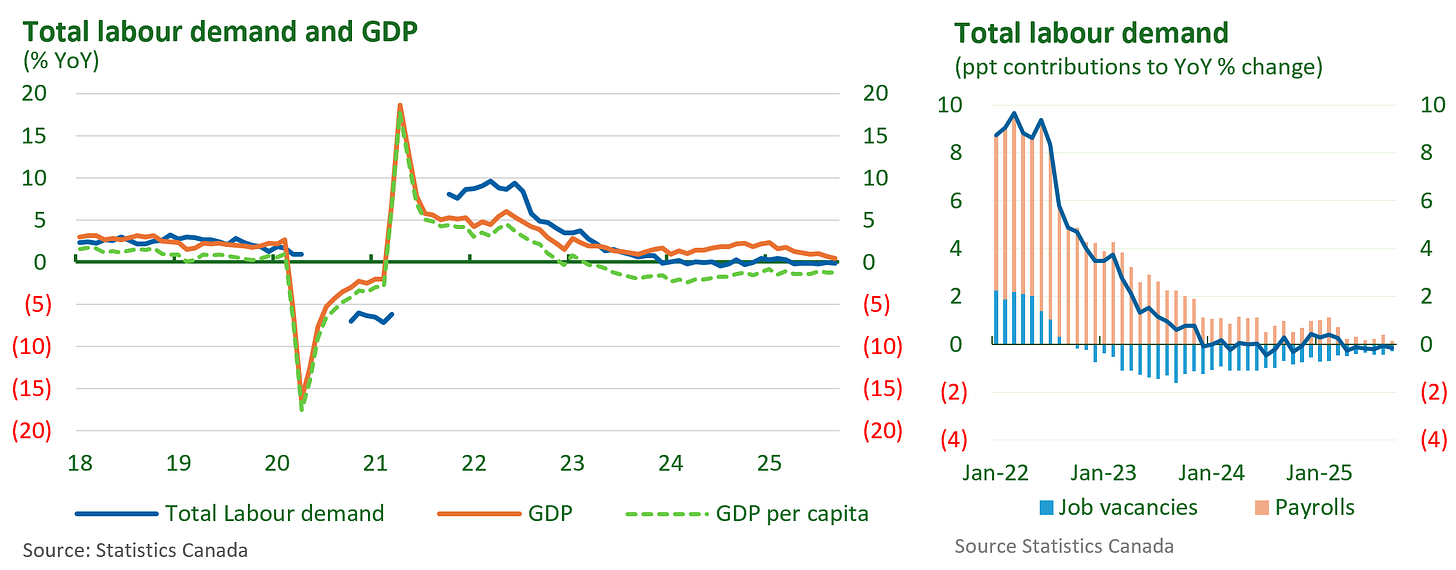

The first chart shows that as of Q3 2025, total labour demand, GDP, and GDP per capita have all essentially stalled. That is, YoY growth rates are quite close to zero. Worrisome. More so, given the challenges presented by the madman in the White House.

The second chart shows the contributions to the YoY rate of growth of total labour demand from payroll employment and job vacancies. Note that job vacancies have been making a negative contribution since late 2022, while the contribution from payroll employment has remained positive.

This chart tells us that much of the adjustment to the labour market over the past few years has been via a decline in the number of job vacancies, and SLOWER payroll growth. That means that firms did not generally reduce payroll employment levels. They might have adjusted the number of employees they needed to add, but the continued to add.

Full or pull?

Total labour demand cooled, some firms might have filled open positions and decided that they did not have to hire additional workers (vacancies filled). Or, maybe, firms found that their order flow was slowing and they might not need more workers (vacancies pulled).

The crucial point, and the key to the “soft landing” scenario during the Bank of Canada’s tightening cycle, is that firms did not resort to reducing payrolls. That is mass layoffs remained moderate overall.

Nonetheless, we are now in a situation where the economy and labour demand are treading water, while still facing significant headwinds.

On that point, the chart on total labour demand shows something intriguing. First note that total labour demand growth has been essentially flat since early 2024. That is, the positive contribution from payroll employment growth was largely offset by the decline in job vacancies.

Though that continues to be the case, the second point to make is that payroll growth is also now close to zero. Meantime, the negative contribution from job vacancies is close to zero. This implies that job vacancies are now stabilizing and thus might imply that there are no more “easy” adjustments to the number of job vacancies.

Basically, the low hanging fruit phase of the adjustment to the labour market is complete. If there is another period of adjustment — such as might happen should there be greater fallout from the uncertain backdrop for trade or from the US tariffs on imports from Canada — the result might be more widespread job losses rather than having the number of job vacancies bear the burden of adjustment.

While central banks have reduced interest rates, and might reduce rates further, the backdrop continues to highlight the risks to household finances and the job market.

The economy remains vulnerable, seemingly on knife-edge.

Let’s all be careful out there.

David Watt | Watt Strategic Economic Advisors